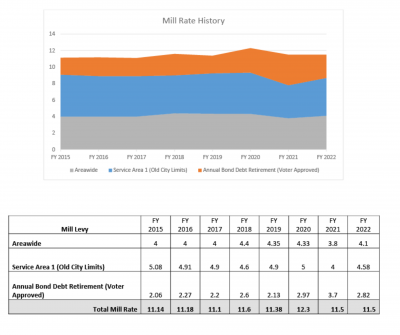

2021 Mill Rate Explanation and History

The adopted operating mill levy for FY22 is 8.68 which is an increase of 0.88 mill from FY21. The debt mill levy is 2.82 for FY22, which is a decrease of 0.88 from FY21. This brings the total FY22 mill levy to 11.5 which is the same as FY21.

The Petersburg Borough has two overlapping taxing areas (Area wide, Service Area 1) plus a separate debt service mill levy. Property can be subject to taxation in one or both of these levies plus the debt service mill levy.

Understanding the mill rate:

One mill is equal to one tenth of one percent. In terms of dollars, one mill equals $1 of taxes per thousand dollars in taxable property value. The current mill rate is 11.5. That means that for every $1,000 in taxable property value, there is a tax of $11.50.

In 1991, the City of Petersburg voters approved a 10-mill operational property tax levy restriction on taxable property. This means that the Borough Assembly cannot raise the mill rate above 10 mills ($10 for every $1,000 in taxable property value) to support general government operations. This restriction does not apply to tax levies for the debt service on general obligation bond. Debt service is the amount required to cover the repayment of interest and principal on voter-approved bonds and is in addition to the operational mill levy.

Applying the mill rate

This example assumes combined $300,000 in taxable property, in both Service Area 1 and Areawide.

$300,000 (property value) = 300 (number of thousands) x $1,000

300 (number of thousands) x 11.5 (total mill rate) = $3,450 (annual property tax)

Of that $3,450 in property tax:

$2,340 per year, or $195.00 per month helps support all aspects of local government including

- schools

- police and fire protection

- roads and sidewalks

- libraries, parks, recreational opportunities, etc.

$1,110 per year, or $92.50 per month, pays for the voter approved bonds.